If you’ve ever sent money through an app or split a bill using UPI or PayPal, congratulations, you’ve already used fintech, but then comes the question ‘What is fintech’. It’s the tech side of finance, and in 2025, it’s everywhere. This article walks you through what fintech means, how it works in your day-to-day life, and how you might be able to use it to your advantage.

What is Fintech?

You’ll hear the word “fintech” thrown around a lot, but it’s not as fancy as it sounds. It just stands for “financial technology,” and that could mean anything from a mobile banking app to platforms that invest your money using algorithms. The real goal? Making money stuff easier. Faster. Less frustrating. Whether it’s helping people get loans without setting foot in a bank or letting small businesses accept payments from a phone, it’s all fintech doing its thing.

What is the purpose of Fintech?

Let’s be honest – money stuff has always been kind of complicated, slow, and in a lot of cases, just plain inaccessible. That’s where fintech steps in. It’s not just about apps and buzzwords. It’s about fixing the old-school systems and making finance work better for actual people.

Making Finance Reachable to All

Traditional banks have rules, minimum balances, and a way of doing things that just don’t work for everyone. Fintech changes that. People who’ve been left out of the system, whether they live far from cities or don’t have the right paperwork, can now access financial tools through nothing more than a smartphone. No waiting in lines. No judgment.

Less Friction, More Control

No one enjoys jumping through hoops just to move their own money. Fintech platforms are built to feel like any other app, which are quick, clean, and easy to navigate. You can send payments, apply for credit, or track your budget in real-time without having to decode technical jargon or deal with clunky websites.

Real Innovation, Not Just Bank Repackaging

This isn’t about putting a digital face on outdated systems. Fintech is rethinking the entire financial experience. Whether it’s investing through a robo-advisor, using a peer-to-peer lending platform, or storing your money in a digital wallet, these tools are designed to work smarter and feel more relevant to the way we live today.

No More Paying for Stuff You Don’t Need

Old financial institutions are heavy. Branches, staff, paperwork it all costs money, and guess who pays for it? You do. Fintech keeps things lean. Fewer people, more automation, and no fancy offices mean services can be offered at a fraction of the cost, and those savings can reach the user.

Everything Just Moves Faster

Waiting days for a transaction to clear or a loan to be approved? That’s the past. With fintech, things happen fast. From instant payments to same-day approvals, the whole process is built around speed and convenience. It’s not just about doing things digitally—it’s about doing them better.

Helps You Understand Your Money

Most of us weren’t taught how to handle money; that is where fintech steps in with tools that fill the gap. Budgeting apps, spending trackers, and financial insights based on your habits all help people make smarter choices without having to be finance experts. It’s about giving people control, not lectures.

History and Evolution of Fintech

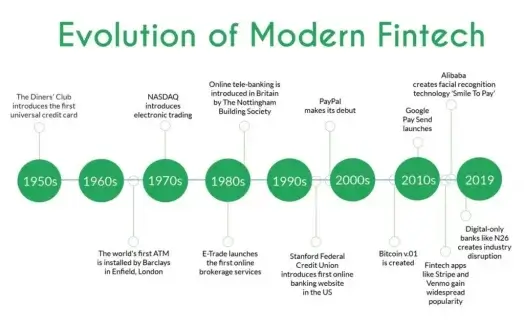

Fintech didn’t just show up one day out of nowhere. Its roots go way back to the 1950s, when things like credit cards and early electronic payment systems first started popping up. That might not sound like a big deal now, but at the time, it was the first real move toward digitizing how people handled money.

Then came the 60s and 70s, and with them, ATMs. This was huge. Suddenly, people could access cash anytime, no longer waiting for a bank to open or standing in line at a branch. It was the beginning of banking without the bank, in a way.

By the time the 80s and 90s rolled around, personal computers and the internet had started to take off. Banks jumped on board and launched online services. Now, you could check your account, transfer money, and pay bills from your home computer. That shift changed how people thought about banking. And it wasn’t just banks that were evolving, e-commerce was taking shape too, and with it came online payment gateways that made shopping online safer and way more convenient.

If you’re curious about that side of things, here’s an interesting read on how e-commerce works.

Things got even more mobile in the early 2000s. Smartphones became more common, and with them came mobile banking apps. Around the same time, peer-to-peer lending platforms started gaining traction. They let regular people lend money to each other without a bank in the middle, and often with better rates for both sides.

Alongside P2P, crowdfunding app development began shaping the way startups and creative projects raised money. Instead of relying only on banks or venture capital, entrepreneurs could reach everyday people willing to back their ideas. This shift showed just how powerful fintech could be in democratizing finance.

In the late 2000s and early 2010s, the rise of blockchain and Bitcoin changed the game again. Now we weren’t just talking about digital money, but we were talking about decentralized money. No banks, no governments, just code and community. That opened the door to a whole new wave of innovation known as DeFi (decentralized finance), and it’s still unfolding today.

More recently, fintech has exploded. And here’s the interesting part: fintechs and traditional banks have started teaming up. We’re seeing hybrid models emerge, where startups bring the innovation and banks bring the licenses, creating something in between a kind of modern fintech bank that tries to offer the best of both worlds.

Importance of Fintech

Fintech is not just changing how we pay for things or move money it’s quietly reshaping the way people around the world interact with financial systems. At a glance, it might look like a handful of apps and platforms. But underneath, it’s solving old problems in new ways and making financial tools more flexible, more approachable, and in many cases, more fair.

Reaching People Who Were Left Out

Access to banking has never been equal. Traditional banks often require paperwork, credit history, or in-person visits, barriers that shut a lot of people out. Fintech skips most of that. With just a phone and a decent internet connection, someone can open an account, apply for a loan, or start saving no, branch required.

Speeding Up the Everyday Stuff

Let’s be honest, nobody misses waiting three days for a transfer to clear. Fintech platforms make those delays feel ancient. Whether it’s splitting a bill, sending money overseas, or getting approved for credit, things just move quicker now. And once you get used to that speed, it’s hard to go back.

Keeping Costs in Check

Old-school banks have overhead, and it shows maintenance fees, transaction charges, and hidden costs. A lot of fintech platforms operate without all that baggage, so they’re able to offer services at a fraction of the cost. That’s good news for users, especially younger ones or small businesses trying to stretch every rupee or dollar.

Giving Users More Control

For a long time, managing money meant trusting someone else to explain it all to you. Fintech flips that. With real-time insights, spending trackers, and smart notifications, users can stay on top of their finances without needing a degree in economics. It makes budgeting and decision-making a whole lot more doable.

What are the features of Fintech?

What Are the Features of Fintech?

Fintech isn’t just about putting banking online. It’s a shift in how people expect to manage their money fast, simply, and on their terms. These features are what define the space.

Everything happens online. You don’t have to walk into a bank or fill out stacks of paperwork. Most fintech platforms are mobile-first, sometimes mobile-only. Whether you’re sending money, checking a balance, or investing spare change, it’s all designed to work from your phone.

A lot of it runs automatically. From recurring payments to savings rules to instant credit checks, fintech leans into automation. You set things once and let the system handle the rest. It saves time, and more importantly, it reduces the number of steps people have to think about.

Real-time matters. Waiting days to see a payment come through is a thing of the past. Fintech platforms prioritize speed. Whether you’re checking your balance or getting approved for something, responses usually come instantly.

Fees stay low. Because fintech platforms don’t run physical branches or carry legacy systems, they avoid the costs that traditional banks pass on. That means lower fees, more transparency, and often better value even for basic services.

It works for more people. Maybe the most important thing: it’s flexible. You don’t need a perfect credit score or a steady 9-to-5 to use fintech tools. If you have a smartphone, you can participate. That kind of access changes everything.

Fintech’s Role in Sustainable Growth

Fintech may not be the first thing that comes to mind when we talk about sustainable development, but it’s quietly playing a part. And not a small one. From the way it increases access to financial tools to how it helps smaller players participate in the economy, fintech is changing who gets to grow and how.

Take financial inclusion. In a lot of places, people still don’t have bank accounts, either because of where they live, how much they earn, or the paperwork involved. Fintech skips the gatekeeping. With just a phone, someone can store money, get a loan, or even invest. That opens the door to participation, which is the starting point of sustainable economic progress.

It’s also worth looking at how fintech supports small businesses. Traditional funding channels aren’t always friendly to startups or first-time entrepreneurs. Crowdfunding platforms, alternative lenders, and microfinancing apps have started filling that gap. They don’t just hand out cash; instead, they give business owners room to grow on their terms.

And then there’s the environmental side. It’s early days, but some fintech tools are already helping people make greener choices, whether it’s tracking carbon footprints through spending habits or investing in companies that align with sustainability goals. It’s not widespread yet, but it’s growing. That’s something to keep an eye on.

Fintech alone won’t fix inequality or climate change. But it’s making financial systems more open, more flexible, and a little more in step with the world’s long-term needs. That in itself is a step toward more thoughtful growth.

Read more: Future of Fintech

Fintech company

It’s not just that fintech companies use technology, but they rethink what finance should feel like in a world that’s moving fast and demanding more. These are the folks making it possible to send money, invest, or borrow without ever walking into a bank. Some, like PayPal, became household names by taking the headache out of online payments. Others, like Robinhood, turned the old-school finance playbook upside down by letting people trade stocks without paying a dime in commission. It’s not about sticking to tradition, but it’s about rewriting it to fit how people live today.

How Does Fintech Work?

Fintech operates through various technological advancements such as artificial intelligence, blockchain, and data analytics. These technologies enable financial institutions, startups, and other entities to offer a diverse array of services, including:

Digital Payments: With the rise of mobile wallets and contactless payment methods, fintech has revolutionized the way we transact, making payments faster, more secure, and more convenient.

Online Lending: Fintech platforms facilitate peer-to-peer lending, crowdfunding, and online loans, providing individuals and businesses with alternative sources of financing outside traditional banking channels.

Investment Management: Robo-advisors and algorithmic trading platforms utilize AI and machine learning algorithms to automate investment decisions, offering personalized advice and portfolio management services to investors.

List of Popular Fintech Apps

Here are some of the well-known and popular fintech apps and startups across categories:

Payments

PayPal

One of the originals in the space. PayPal lets people and businesses send and receive money online without sharing bank details. Whether you’re buying something off a website or paying back a friend, it’s fast and usually pretty seamless.

Square

Built with small businesses in mind, Square started with those little white card readers you’d see at pop-up shops and cafes. Now it offers full point-of-sale systems, online payment tools, and even loans to help businesses stay on their feet and grow.

Stripe

Stripe works more behind the scenes. If you’ve ever paid for something online, there’s a good chance Stripe processed that payment. It’s built for internet businesses — handling subscriptions, checkouts, and everything in between for startups and large companies alike.

Wise (formerly TransferWise)

Wise is all about international money transfers, and it does it in a way that’s cheaper and more transparent than most banks. It uses real exchange rates, shows you the fees up front, and gets the money where it needs to go without the usual headaches.

Trading & Investment

Not too long ago, investing felt like something reserved for Wall Street insiders or people with enough cash to hire financial advisors. Now? Anyone with a phone and a few bucks can get started. Fintech platforms have made trading smoother, faster, and a lot more approachable.

- Robinhood: Robinhood shook things up when it introduced commission-free trading. It lets users invest in stocks, ETFs, options, and even crypto with no brokerage fees, no paper forms, just a clean interface and a simple setup.

Know more about how Robinhood makes money –How does Robinhood make money

- StashInvest: Stash is part investing app, part financial coach. You can start with as little as $5, and it guides you through picking investments based on your goals. It’s especially useful if you’re new to the world of stocks or want help figuring things out along the way.

Find out more about how does StashInvest work

Digital Banking & Finance

The banking world isn’t what it used to be. You no longer need to walk into a branch, fill out a stack of forms, or wait days for a transaction. With fintech tools, your phone is basically your bank, and the options keep growing.

- Revolut: Revolut packs a bunch of tools into one sleek app. Currency exchange, budgeting, crypto trading, and international transfers, all in one place. It’s built for people who move fast, spend globally, and want control over their money on the go.

- Klarna: Klarna made “buy now, pay later” mainstream. You shop online and break your payment into smaller parts — sometimes interest-free, sometimes with financing. It’s become a go-to option at checkout for people who want flexibility.

- Credit Karma: Want to check your credit score without paying for it? Credit Karma lets you do that and then goes further by giving you tailored recommendations to improve your financial health, track your credit, and even explore loan or credit card offers.

Read more about how Credit Karma works; how does Credit Karma work

- SoFi: SoFi (Social Finance) does a bit of everything. You’ll find personal loans, student loan refinancing, mortgages, investment tools, and even career coaching. It started as a lending platform but quickly evolved into a full-service financial hub.

- Chime: Chime is one of the leading neobanks, known for its no-fee approach to banking. It offers checking and savings accounts, early access to direct deposits, and features like automatic savings, all handled through a clean, user-friendly app.

- Plaid: You have probably used Plaid without realizing it. It’s the backend that connects your bank account to apps like Venmo, Robinhood, or budgeting tools. Developers use it to build secure, data-connected financial services.

- Afterpay: Afterpay is another “buy now, pay later” app, but this one focuses on interest-free payments split across several weeks. It’s often embedded right into checkout pages, giving users the flexibility to manage purchases over time.

Explore more about how Afterpay works; how does Afterpay work

- Monzo: Monzo is a mobile-first bank that’s big in the UK and expanding fast. You get a current account, savings tools, and real-time budgeting insights, all in one place. It’s designed to help you manage money better, not just store it.

Discover how Monzo works and learn more about its features and services in our detailed guide on how does Monzo work.

-> If you are looking at developing your Fintech app like the list here, check out some of the top Financial Services App Development Companies

Cryptocurrency

Digital currencies went from fringe curiosity to a full-blown financial category. Whether you’re just watching Bitcoin prices or deep into trading altcoins, crypto platforms have opened a whole new way to think about money.

Coinbase is one of the most beginner-friendly ways to buy and sell cryptocurrency. It supports popular coins like Bitcoin, Ethereum, and Litecoin, and it’s built for both casual users and serious traders. You can hold your assets, track your portfolio, and learn as you go, all in one app.

Find out how Cryptocurrency works; How does Cryptocurrency work

Crowdfunding

Main article– How does crowdfunding work

Sometimes, the best ideas don’t come with deep pockets. That’s where crowdfunding steps in. Instead of pitching to one big investor, people raise small amounts from a larger crowd, usually online. It’s part funding, part validation, and sometimes even a launchpad for a whole community.

Creators, early-stage startups, and nonprofits all use crowdfunding to test the waters and build momentum before anything officially goes live. You’re not just asking for money. You’re inviting people to believe in what you’re building.

- Kickstarter: One of the most popular platforms out there. Kickstarter focuses mostly on creative work, such as tech gadgets, films, games, and art. Backers pledge money, usually in exchange for early access or rewards. If the funding goal isn’t met, no money changes hands.

Explore how Kickstarter works in our detailed guide on how Kickstarter works

- Indiegogo: A bit more flexible than Kickstarter. Indiegogo hosts everything from passion projects to tech launches to social causes. Campaigns can keep the funds they raise even if they don’t hit the full goal, depending on how they’re set up. Perks or no perks, it’s up to the creator.

Know more about how IndieGoGo works in our article; how does Indiegogo work

These fintech apps and startups have gained significant popularity and recognition for their innovative solutions in the financial services industry.

Fintech Products

Fintech isn’t just some niche corner of the finance world anymore. It’s become part of how people deal with money every day. Some of it you notice, like paying through your phone or checking your balance in an app. Other parts are running quietly in the background. Either way, these products have changed the game. They’re not just digital. They’re practical. They work because people use them without even thinking twice.

Digital Wallets

Think PayPal, Apple Pay, Google Wallet. These tools let you pay online or in-store without ever pulling out your card. They store your payment info securely, and everything happens in a few taps. You barely think about it. That’s the point.

Peer-to-Peer Lending

Platforms like LendingClub or Prosper give people the chance to borrow money directly from others. No bank in the middle. Borrowers may get better rates. Lenders can earn some returns. It’s simple, and it’s personal finance outside the usual gatekeepers.

Robo-Advisors

Not everyone wants to hire a financial advisor, and that’s fine. Services like Betterment or Wealthfront use algorithms to build and manage portfolios. They’re affordable, easy to set up, and good for people who want to invest but don’t want to get deep into the weeds.

Crypto Exchanges

Coinbase, Binance, and a bunch of others let users trade cryptocurrencies like Bitcoin or Ethereum. Some people are in it for investment. Others just want to explore what digital assets can do. Either way, these platforms make it accessible, even if you’re new to the space.

Insurtech

Insurance used to be paperwork-heavy and slow. Now, companies like Lemonade are rethinking the whole process. Want to insure your apartment or your dog? You can do it in minutes through a clean, mobile-friendly app. That’s a big leap from traditional insurance models.

Mobile-First Banks

Apps like Chime, Revolut, or Monzo offer full-service banking without the branches. No overdraft fees, real-time alerts, and budgeting tools built in. For people tired of hidden fees and long queues, these apps are a breath of fresh air.

Know more about how Revolut makes money in our article; How does Revolut make money

Who Benefits from Fintech?

Fintech doesn’t sit in one corner of the financial world. It’s everywhere now. And the people who benefit from it? There’s no single type.

Consumers

The biggest winners might just be regular folks. People who used to rely on in-person banks can now manage almost everything from their phones. Checking balances, transferring money, paying bills, even applying for a loan, it’s all right there. No need to wait in line or figure out banking hours. It just works when you need it to.

Small Businesses

Running a small business is tough. Fintech has taken some of the pressure off by giving business owners tools that used to be expensive or hard to access. You’ve got payment apps, accounting tools, and instant lending platforms. All of that helps owners stay focused on work instead of paperwork. That’s a win.

Financial Institutions

Even the old players in finance, the traditional banks, have started using fintech to clean up slow processes and upgrade their customer experience. It’s not just about survival anymore. Some are getting smarter about how they use data, automate boring tasks, and keep their systems sharp.

Investors

If you invest, you’ve felt the shift. You no longer need a financial advisor on speed dial. Whether it’s buying crypto, auto-investing through a robo-advisor, or just watching the markets from your phone, fintech has made investing way more accessible. You don’t need to be wealthy to start.

Regulators

This one’s not talked about much, but regulators are part of the story, too. They’ve had to rethink how to protect consumers and keep systems fair without blocking innovation. It’s a tricky place to be, and they’re figuring it out as they go, just like the rest of us.

Developing Countries

Here’s where fintech does something bigger than convenience. In regions where banks never reached or where people couldn’t open accounts, mobile banking has stepped in. It’s giving millions access to basic financial tools like savings, payments, and small loans. For a lot of people, it’s the first time money has felt manageable.

Impact of Fintech on Traditional Banking

Traditional banks aren’t what they used to be. Not because they wanted to change, but because fintech left them no choice. When people realized they could move money, check balances, and get approved for loans on their phone, all without stepping into a branch, expectations shifted fast.

Fintech didn’t just bring competition. It changed the rules. And while some banks scrambled to upgrade their tech, others still feel clunky by comparison. Smooth user experience isn’t a nice-to-have anymore. It’s the baseline.

The cost structure is different, too. Fintech companies run lean. No massive physical branches, no outdated systems slowing things down. That means better pricing, faster service, and in many cases, a more modern approach to money. Traditional banks have had to adapt, and not all of them have nailed it.

Another shift? The options available now. Peer-to-peer lending, digital wallets, instant payments, the tools that didn’t even exist in mainstream banking a decade ago, are now everywhere. And customers expect them.

One of the biggest wins has been access. Millions of people who were ignored or underserved by banks can now use a smartphone to save, send, or borrow. That’s real progress.

Of course, this rapid growth comes with its problems. Regulation hasn’t fully caught up. There’s still work to be done in making sure innovation doesn’t come at the cost of security or fairness. But there’s no turning back now as fintech has reshaped the space, and traditional banking is still trying to keep pace.

Check out the list of top financial software development companies.

Utilizing Fintech in 2025

Let’s be honest here, money management has changed. Fast. Fintech isn’t some niche trend anymore; it’s baked into how people bank, invest, borrow, and move cash around. So if you’re still doing things the old way… it might be time for an upgrade.

Digital banking should be your baseline.

No, you don’t need to go full ‘finance nerd’, but if you’re not using a banking app that lets you deposit checks, track spending, and ping you when something looks off, you’re missing out. It’s about saving time and staying in control without needing to visit a branch or wait on hold.

Crypto? It’s still here.

Yes, the hype comes and goes, but blockchain, DeFi, and digital assets aren’t going anywhere. Don’t jump in blindly. Learn first. Start slow. Maybe test out a crypto wallet or dabble in decentralized finance (DeFi) platforms. Not everything’s a moonshot, and that’s fine.

Also… keep watching the space.

New stuff drops all the time to digital currencies from central banks, better fraud detection, tighter regulations (for better or worse). Staying a little updated goes a long way, especially when the rules and risks keep shifting under your feet.

No need to overhaul everything you do. But in 2025, ignoring fintech? That’s a bigger risk than embracing it.

TL;DR – What is Fintech?

Fintech basically means using tech to make money stuff easier. No more standing in line at the bank or filling out a million forms just to get a loan, now it’s a few taps on your phone. Want to split a bill? Send cash instantly? Track your spending before your next “where did all my money go?” moment. That’s fintech making things simple.

And here’s the cool part: it’s not just for tech bros or finance pros. It’s for the friend who just bought stocks with $10. It’s for small business owners who get paid faster through digital invoices. It’s for anyone who wants more control over their money without jumping through hoops. Whether you’re saving, borrowing, investing, or just keeping tabs on your expenses, fintech is quietly changing how the world handles money and honestly, it’s about time.

Building a Fintech Startup?

Get advice from our experienced team building award-winning Fintech products and scaling successful startups for over 20 years. Contact us today for a free quote on your Fintech software development project.

How did you find this article? Tell us in the comments section and share this article on your blog or social media to spread the word. Thank you for reading.